The role of the voluntary carbon market in driving the business case for CCS

31 January 2025

The voluntary carbon market (VCM) has come to make up an increasingly larger share of the business case for most carbon capture projects. However, uneven development and lack of standardisation raises important questions about the future pricing outlook and its role in driving the commercial viability of carbon capture and storage.

Why a voluntary carbon market?

Carbon Capture and Storage (CCS) is increasingly acknowledged as one of the more promising solutions for enabling substantial, permanent carbon reductions. The main commercial driver underpinning the business case for carbon capture is known to be the CO2 quota savings on fossil emissions under the ETS or other national taxation schemes. However, the price of ETS quotas has been falling far short of what is needed to cover the investment. Consequently, most projects now turn towards alternative markets as they struggle to bundle sufficient revenue streams to ensure bankability.

The sales of Carbon Dioxide Removal (CDR) credits in the Voluntary Carbon Markets (VCM) has, however, in recent years emerged as a nascent yet promising new financing instrument to supplement the business case.

CDR credits are issued for projects that actively remove CO2 from the atmosphere, such as reforestation, soil carbon sequestration, or more technical solutions like bioenergy with carbon capture and storage (BECCS) or direct air capture and storage (DACCS). Currently, this market features just a few handful of buyers, primarily private companies, who are voluntarily utilizing these CDR credits to supplement their existing decarbonization efforts as part of reaching their company-wide net-zero targets.

The market for credits has been characterized by a dynamic and uneven development over the past decade due to challenges related to quality assurance, transparency, lack of standards and regulatory oversight. Yet, CDR credits arriving from technical removals, such as BECCS, have in recent years been increasingly acknowledged as high-quality and durable credits – exemplified by a growing number of large volume transactions. As the market evolves, the reliability and scalability of technical removals may position them as increasingly sought-after products.

For project developers of carbon capture projects, this raises important questions about the future role of VCM in making carbon capture and storage commercially viable.

Carbon dioxide removal (CDR) makes up an increasing share of total market value

In 2020, the market saw a rapid rise in both the volume of credits traded and the overall market value, as many companies ramped up their commitments to carbon neutrality driving demand for carbon credits to compensate for their emissions. This surge continued into 2021, marking a stark contrast to the slow development of previous years.

The market has since faced a sharp decline, with both volumes and overall market dynamics softening. This decline raises important questions about the future trajectory of VCM, particularly in terms of balancing growth with the necessary standards of integrity and quality that will secure long-term success.

Figure 1: Historical value and volume of the global voluntary carbon market.

The year 2022 revealed some critical shifts within the market. While the volume of traded credits more than halved compared to the peak in 2021, the market's total value remained relatively stable.This resilience in market value signaled a clear transition: buyers were moving away from low-quality carbon credits and increasingly opting for high-quality credits, which command a higher price. This shift reflects a growing recognition of the importance of quality assurance in the VCM, driven by corporate demand for more credible and impactful carbon crediting projects.

In 2022, technical CDR credits, though still a small portion of the market, became more visible in data, accounting for approximately 2% of total market share by volume. While this may seem modest, the market value contribution of these technical credits tells a different story. Due to their higher price compared to other carbon credits, it is estimated that technical removal credits represent a much larger share of the total market value – likely 33% or more.

Figure 2: Volume and value of retired credits in the global voluntary carbon market (% of total market value, 2022).

This disparity between volume and value highlights the increasing importance of high-quality, technical CDR solutions, such as BECCS, in the VCM. Even amid the overall market decline in 2023, the demand for technical removal credits continues to grow, driven by corporate net-zero commitments and the desire for durable, long-term solutions.

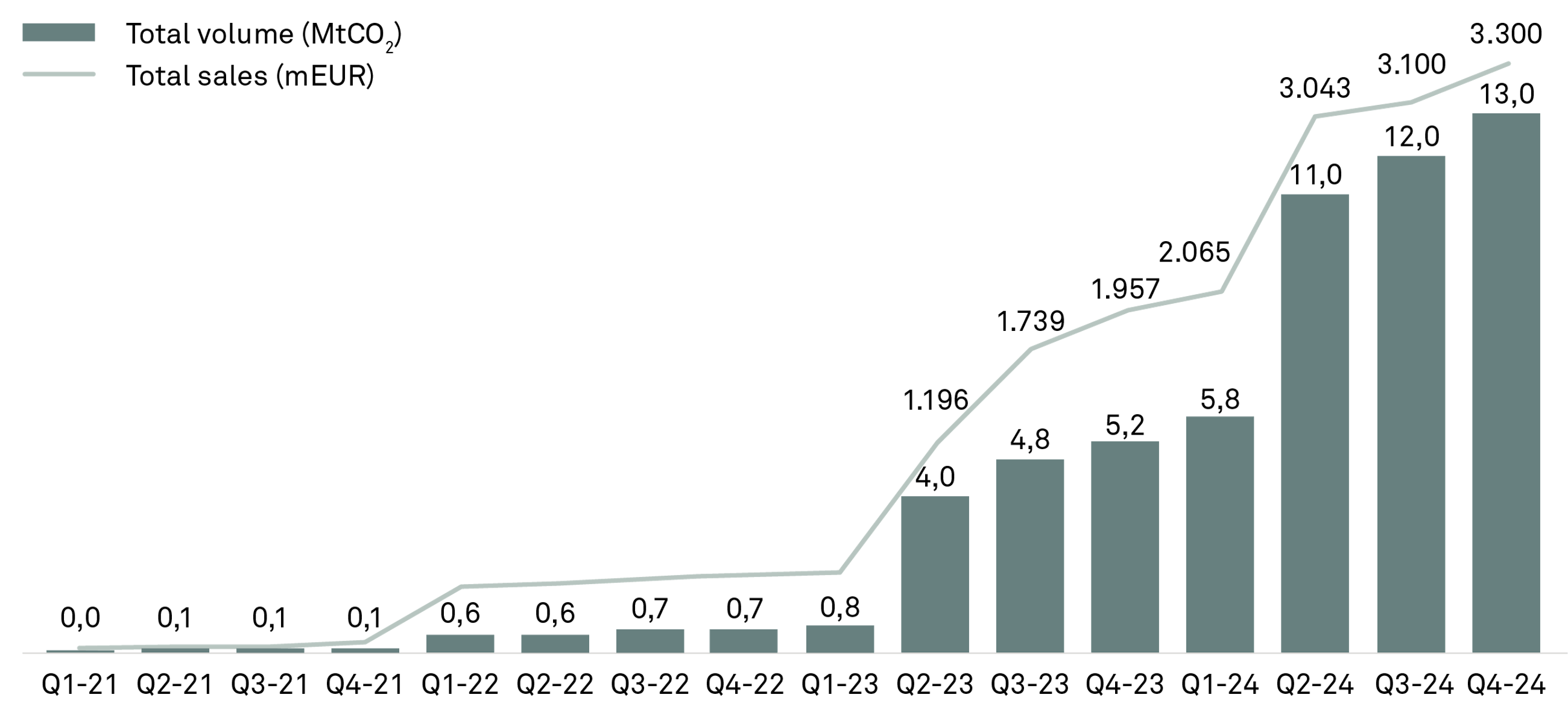

Figure 3: Accumulated value and volume of the global voluntary carbon market for technical removal credits.

Market outlook for technical CDR

The implications of the historical trend are clear: technical removal credits, though limited in volume today, are becoming a cornerstone in the value proposition of the VCM. As buyers prioritise higher-quality credits with measurable, long-lasting impact, technical CDR projects will likely command an even greater share of the market moving forward.

Future scenarios aligned with global climate goals suggest a significant increase in demand for carbon removal, potentially reaching 900 MtCO2 by 2030, 1,700 MtCO2 by 2040, and 3,500 MtCO2 by 2050. This projected growth underscores the rising importance of technical carbon removal solutions.

As demand for technical CDR credits grows, these credits are expected to command higher prices, with current estimates ranging from around 150 EUR for BECCS to 450 EUR for DACCS per credit. These prices are only indicative and meant to represent the order of magnitude of prices. The actual CDR price that can be realized for a given project will depend on multiple factors, including delivery date, volume, project type and project quality.

Even conservative scenarios forecast a substantial increase in the market value of these credits in the coming decades, underscoring their rising importance. The expected growth in both demand and price signals a strong opportunity for companies involved in technical carbon removals, as their solutions will likely become a cornerstone of the voluntary carbon market.

Figure 4: Future Paris-aligned demand scenarios for global carbon removal (MtCO2).

Implications for project developers

The evolving dynamics of the VCM present both opportunities and strategic challenges for CCS projects under development.

The high market value of credits derived from the storage of biogenic CO2 (BECCS) presents significant market potential for CCS projects. Companies like Microsoft have already signaled their preference for CDR credits from biomass power generators, setting a precedent for other potential buyers. However, some buyers also show a growing interest in diversifying the sources of biogenic emissions eligible for credits, including those from waste management and sectors like cement, lime, pulp, and paper.

Despite this, the market for CDRs is yet far from a commodity market. Deals are demand driven and made on a project basis in a partnership between buyer and project developer.

This leaves project developers with several key strategic questions to address:

- First, what is a realistic price expectation for the CDRs and at which price level might the sale of physical biogenic CO2 be a more attractive option?

- Secondly, how many CDR credits to sell before financial investment decision (FID) to de-risk the project and secure financing? And to what degree can one rely on expectations for future demand?

- Lastly, are companies willing to pay a premium for high-quality biomass-based removals, and what trade-offs exist between the quality of the biomass and its associated costs?

Project developers expecting to sell CDR credits should be aware that buyers are likely to impose a very extensive due diligence process to ensure the quality, viability, and durability of the project. Or put differently – you are not selling credits, but rather selling the entire project. This means that ensuring the commercial maturity of the entire project – with strong commitments from shareholders and lenders, technology providers and downstream service providers – becomes an essential part of ensuring the attractiveness of the project and the overall valuation of the credits.

Early engagement with multiple potential buyers is crucial to increase the chances of securing a deal in a selective buyer’s market.

Sellers should expect the process from feasibility assessment to a firm CDR offtake agreement to take over 12 months. During discussions with potential buyers, it is beneficial to demonstrate a strong understanding of buyer requirements and the standards and methodologies for certifying CDR, including their merits and shortcomings.

Companies developing CCS projects with high-quality biomass sources and early buyer engagement will be well-positioned to capture value as the market matures and technical CDR projects expand.